A couple months ago I wrote you about out-of-state staff i.e., when you have employees in states other than Michigan. Trying to avoid the 27-point test, I broke it down to a few simple points that work in nearly all cases. That article prompted many calls from you, and I think we answered your individual questions. With that topic mostly behind us, the next logical area is “when are my subcontractors (and their employees) MY employees?” Like the complicated list of test questions for an employee’s coverage state, the sub-contactor test is just as complicated and varies widely by state. I will focus on Michigan rules but use a couple other state examples to illustrate the state differences.

(more…)Is this the employee covered in Michigan, or another state?

Part of my daily tasks is answering member’s questions. When a particular question begins to surface weekly, it’s time to share the question and answer with all of our members. The recent regular question looks like this “Is my employee in Indiana covered by my MTM policy?” With more remote working going on especially in sales and clerical/engineering jobs it seems logical that this question is coming up more.

While the rules can vary by state, and in fact even in Michigan there is a complicated more than 15 question criteria that is used, there are three or four much more simple questions that answer the vast majority of situations. Because our members need quick reference answers, let me walk you through this simple criteria.

(more…)By Donna Motley, Vice President of Claims

Summer is over, schools are back in session and hopefully, more people are returning to work. Everyone is aware of the “worker” shortage. Employers are placing signs outside their establishment seeking candidates. Some fast food restaurants have limited their hours of operation and some only operate the drive through window.

Advertised are: sign-on bonuses, paid college tuition, health care benefits, etc. Now that recreational marijuana has been legalized, prospective employees have one less hurdle to worry about. I just can’t imagine being on lay-off status and not looking for work.

(more…)By Chris Demeter, Senior Loss Control Consultant

Over the years, I have been in more fab shops than I can remember. The equipment in these shops may vary, but most are equipped with different types of saws, welders, and various pieces of metalworking equipment. One of the most common pieces of metalworking equipment is the power press brake. These metalworking machines bend and form parts through the use of tooling (dies) attached to a ram or slide and a bed. Metal working occurs by placing stock, primarily sheet metal, on a bottom die and pressing it with a top die attached to the movable ram. Press brakes are mechanically or hydraulically powered, or both (hydra-mechanical brakes combine both). Mechanical (flywheel) press brakes use either mechanical friction or air friction clutches that can be disengaged at any point before the crankshaft has completed a full revolution and the press slide has completed a full stroke. By inching and slipping the clutch, these presses allow the operator to drop the slide to the work piece and stop, adjust, or align the work piece, and then complete the stroke. Hydraulic press brakes can normally be stopped at any point in their cycle and the force exerted by the dies can be varied. Operating speeds are normally slower than mechanical presses; however, because of their slower operating speeds they are normally not fully automated. Hydra-mechanical press brakes combine hydraulic and mechanical operations into one system.

(more…)Safe and Sound

Normally each month I update you on changes in workers’ compensation law, operating environment, MTM news or questions I have recently received from members. An important item, that I should inform you about is how to we manage the money MTM members entrust us with. That ties into a very common question, tell me about MTM’s financial security. MTM is NOT a billion dollar national insurance company. We ARE a mutual insurer owned by 941 Michigan employers. One can argue that there is more stability in these large international companies, but events over the last ten years have shown that large does not necessarily mean stable. Financial stability also factors into how the MTM Board of Directors review our annual members’ dividend. Over the last seven years, the MTM Board of Directors has returned $27 million dollars as owner member dividends. That equates on average to 30% of the annual premium. Dividend payments starts with financial stability. It does not do any good to return monies to member owners only to say that we’ve come up short and need more money to pay claims. So while the dividend part of the member equation is critical, making sure that the financial stability of MTM comes first.

(more…)By Donna Motley, Vice President of Claims

We have received many requests in relation to whether or not employers can mandate COVID-19 vaccinations for their employees. I reached out to one of our attorneys, William Buie of Conklin Benham to provide information that could be shared with our policyholders. Below is the information that I received from him:

The U.S. Equal Employment Opportunity Commission (EEOC) recently issued guidance stating that employers can generally mandate Covid-19 vaccines for employees who physically enter the workplace without violating federal antidiscrimination laws. However, employers requiring employees to get vaccinated need to consider religious and disability related objections and explore reasonable accommodations that may be required under the Americans with Disability Act.

(more…)A Look Back – 2020

Every quarter the MTM Board of Directors meet. No surprise the MTM management team prepare a variety of reports for Board review. The 11 MTM Board members are just like you, shop owners, CFOs, plant managers, safety managers, H.R and the like. For the upcoming meeting, I thought the Board would be interested in a big picture of what we learned from the completed payroll/premium audits for 2020 policies. Those audits often take 3-6 months before all is finalized.

Back in January/February of 2020 there was some chatter about a contagious disease, but nothing much changed until mid-March. Then most everything was locked down. MTM had just begun delivering member dividend checks and we found we had to slip the check under the door if someone was at the shop at all. With a rapid decrease in shop payroll, we offered to make premium payment adjustments, knowing that some shops were closed or operating at very reduced staff. To our surprise, we had fewer shops requesting that assistance than we expected. That gave us the feeling that more shops were operating as essential than we first thought.

(more…)By Donna Motley, Vice President of Claims

Finally, as promised, the Workers’ Compensation Courts are now open for “in person” business! Any way you look at it, this is a good thing! Over the last one and one-half years, the Workers’ Compensation Courts were still conducting business, but like everyone else in the business world, communication was via telephone or (computer) Zoom. While I can’t necessarily speak for Plaintiffs, I can tell you the Defense side of Workers’ Compensation is happy with the re-opening. It will take a while to get cases back “on track” but so far everyone in the litigation field seems anxious to get back to work.

(more…)By Ruth Kiefer, MSc, ARM

As my team and I continue to assist you with the most recent COVID-19 rules and regulations, we are still fielding questions regarding outbreaks and what to do if an employee tests positive. Awhile back, MIOSHA dialed back their requirements for protecting your employees from COVID-19 and are now highly recommending that employers follow the updated CDC guidelines due to the Delta variant.

(more…)Finally, back to some normalcy. It’s been over a year, but finally MTM Board and Committee members are together again. Maybe 2/3’s of the members were at the MTM office and 1/3 via Zoom. It was great to see our Board and Committee members. It was like a family reunion. At the May 20th Board meeting Joe Keppler, MTM Chairman of the

Board welcomed our new Board member Barry Kavanagh. Barry might hit a memory cell for you because about 3 years ago I introduced him as a new Board Finance Committee member.

Here’s a refresher: Barry received his bachelor degree from Waterford Institute of Technology in his native Ireland. He is a Fellow of the Association of Chartered Certified Accountants (ACCA), the main accountancy body in the United Kingdom, Europe, and Asia. He also holds a certified management accounting certification from the U.S. Institute of Management Accountants. Barry has been involved with MTM for nearly 15 years. At the beginning we worked with Barry when he was the Controller at a Lansing member’s shop. For the last 8 years, Barry has been the VP of Finance at Avalon & Tahoe Mfg. Inc. That company name might sound familiar too. Avalon & Tahoe is a high end Michigan manufacturer of pontoon boats. They make virtually everything on their boats except the motors and gauges. It is a fascinating company. The company won the Michigan Manufacturers Association “Michigan Manufacturer of the Year” award for 2019.

Well, back to Barry. After two and a half years of successful work on the Board Finance Committee, the Board asked him to join them on the full Board. Consistent with Barry’s enthusiasm on the Board Finance Committee, he agreed to the new position as long as he could retain his Board Finance Committee assignment. The Chairman of the Board of MTM approved his request. Barry has been a valuable contributor to the Board Finance Committee, and we are expecting that same solid contribution to the full MTM Board.

Lastly, with many of our in person activities resuming, we are planning the Annual Member’s Meeting October 21st (11 a.m. – 2 p.m.). As it has been for the last 6 years, the get together will be held at The Inn at St. Johns, Plymouth, Michigan. The Inn is a first class location and there is no “convention food” served. All Board and Committee members attend this meeting as does the entire MTM staff. We hope you can join us.

By Travis Halsted, ARM, COSS, Loss Control Consultant

It was just a few months ago that I was discussing icy parking lots, and shoveling snowy walkways with many of you. Oh, how the seasons have changed. As the temperatures rise, so do the risks in the workplace. The brain and body take part in a dance to keep the body cool. Each year, over 600 Americans die from heat exhaustion. While the majority are well aware of the measures that we can put in place to help with heat levels while the employee is working (fans, air conditioning, breaks), I think we could even look at heat preparation from a different angle.

As the health and safety field is based on preventing injuries/accidents, it is paramount that we try to be proactive with employees before they even enter the workplace. The next few items will provide some proactive measures that employees can utilize at work, at home, and really any event where they can expect to enter a high temperature environment.

(more…)Recently, MIOSHA has rescinded their Emergency Order and dialed down their requirements. They are strongly encouraging businesses to follow the CDC and OSHA guidance concerning protecting your workers from COVID-19 and allowing you to use your judgement in continuing using your COVID-19 Response Plans. What does that mean exactly? What are your obligations to your employees? Will they fine you? The good thing is, you are already prepared to follow the CDC/OSHA guidelines, you have your COVID-19 Response Plan, you are completing your health screenings, and you are protecting your unvaccinated employees by social distancing and/or requiring them to wear masks when they can’t maintain six feet of distance from others.

As referenced by OSHA, the CDC’s Interim Public Health Recommendations for Fully Vaccinated People explain that under most circumstances, fully vaccinated people need not take all the precautions that unvaccinated people should take. For example, CDC advises that most fully vaccinated people can resume activities without wearing masks or physically distancing, except where required by federal, state, local, tribal, or territorial laws, rules and regulations, including local business and workplace guidance. OHSA is recognizing the vaccination status of your employees, so if 100% of your employees are fully vaccinated, then you may stop reading and go about your life as if there is no pandemic, this is the carrot of the governing agencies. However, if you have employee’s that are not fully vaccinated, then continue on with the read. Remember, MIOSHA does have the duty to protect Michigan workers and has the flexibility to rule under OSHA.

(more…)By Donna Motley, Vice President of Claims

I didn’t grow up in a wealthy family. I received an allowance for weekly chores. Chores were not gender specific – my sisters and I did everything. We were expected to learn to budget our money. I can remember specifically receiving 25 cents per week and saving up to buy a record album that cost $3.50. Once I started to babysit (at age 12), I no longer received an allowance nor did my mother buy me clothes other than for birthday or Christmas. I was expected to buy my own clothes with the exception of an occasional purchase of material by my mother so I could sew my clothing. My best friend had the identical situation. I couldn’t wait to start working, which I did while in high-school at the age of 17. And yes, I would still babysit (at 25 to 75 cents an hour)! Right or wrong, it sure motivated me! I couldn’t wait to start working and earning money.

The point of my story – “COVID” Unemployment insurance and all the extras, is due to end – or least be substantially reduced. Theoretically, that should put a flood of people back in the workforce. I know employers are screaming for employees. It seems EVERYONE needs help! Bless the first responders and front line workers, but I think they are suffering from “burn out”. I drove past a cemetery last week that had a sign out front indicating “Help Wanted – $15.00 per hour”. The $15.00 per hour seems to be the magic number. I’m sure the cemetery is not looking for someone to dig holes in the ground – that would be a heavy equipment operator earning much more per hour. How hard could the job be? Picking up pine cones dropped by the trees? Trimming around headstones? Picking up trash? Painting a gate? While it might not be a career choice, it would certainly put money in your pocket.

So, if and when applicants are at your door, (assuming they will be), there are a few things you should consider:

(more…)MTM Annual Members Meeting is October 21, 2021 at the Inn at St. John’s. We are pleased to have Kristi Stepp, a partner with Sigred Solutions as our keynote speaker presenting, Leading With a Growth Mindset. Kristi has over 25 years of human resources experience in the automotive, healthcare, food/beverage and workforce solutions industries and has a broad international and multicultural expertise.

Before joining Sigred Solutions, Kristi served in strategic human resource roles at several leading global organizations including General Motors, Kelly Services, Pepsi-Cola and Volkswagen. Kristi holds a bachelor’s degree from the University of Michigan and master’s degrees from Central Michigan University and Fielding Graduate University. In addition, she is a certified Global Professional in Human Resources (GPHR), holds the Master Human Capital Strategist (MHCS) designation, and is a Senior Certified Human Resources Professional (SHRM-SCP). Kristi gives back to the community as a board member of Focus: HOPE and as a board trustee for Pewabic Pottery, both based in Detroit, Michigan.

(more…)Normally, each month, I tell you about MTM member ownership benefits, a workers’ comp update, or some change in the legislative or workers’ comp arena and how MTM is responding to it. I can’t remember over the last eight years ever giving you an update about MTM internal operating systems. So, this report is a first.

Like many of our members when MTM finds a good I.T. system we stick with it for many years. Our policy accounting/underwriting system gets regular updates, but it is the same basic system we have had for 12 years. The other major system we have is our claims system and we acquired it from a separate vendor from our premium accounting system. To increase functionality and obtain long-term enhancements we felt tying our premium accounting/underwriting and claims systems together would be the best way to achieve this. Another benefit would be to bring more information, more quickly to our member portal (which happens to presently reside in our premium accounting/underwriting system.)

(more…)The Michigan Occupational Safety and Health Administration (MIOSHA) this week issued updated COVID-19 workplace rules that all employers must follow. The rules supersede the Emergency Rules (“Rules”) filed on Oct. 14, 2020, and extended by the Governor in April through October 2021.

These rules have been scaled back for those who are vaccinated and are designed to be more aligned with the new Centers for Disease Control (CDC) guidance and the Michigan Department of Health and Human Services (MDHHS) Epidemic Orders (current and new as of June 1). The new Rules require employers to:

(more…)By Chris Demeter, Senior Loss Control Consultant

How many of you remember your first paying job? My first job was at Kentucky Fried Chicken. At 16-years old, I was frying chicken in 350°F oil in a pressure fryer until golden brown. I do recall a few burns from splattering oil while performing my duties. Overall, the job was alright since I was able to eat all the chicken I wanted and I saved up enough money to buy my first car. It was a 1970 Ford Torino GT, in which I tended to have a lead foot that led to a few unwanted but deserved traffic tickets. According to my wife, I drive like a grandpa now so no more driving like that young inexperienced driver.

Young workers have high rates of job-related injury. According to the Department of Labor, in fiscal year 2020, teens age 15-19 were treated in the emergency room for a workplace injury approximately every 5 minutes. These injuries are often the result of the many hazards present in the places they typically work, such as sharp knives and slippery floors in restaurants. Young workers are at risk of workplace injury because of their inexperience at work and their physical, cognitive, and emotional developmental characteristics, and a lack of safety training also contribute to high injury rates. They often hesitate to ask questions and may fail to recognize workplace dangers. To help address this problem, MIOSHA enacted the Youth Employment Standards Act 90 of 1978. The Act defines a minor who is less than 18-years of age, including but not limited to employees, volunteers, independent contractors, and performing artists.

(more…)The most important item at the February MTM Board Meeting is the review of the prior year’s financial results to determine the MTM members’ dividend. That clearly is the most important task of the year for our MTM members. However every three years a second important task occurs at the February Board meeting. That is the election by the Board of the Board leadership. This year, after the dividend tasks were taken care of, the Board discussed and then decided on its leadership for the next three years. For the next three years, the new MTM Chairman is Joe Keppler (Shuert Technology). The Vice Chairman is Mark Mullen (Griggs Steel Company). And the Chairperson of the Board Finance Committee is Teena Kolwalski (Repair Clinic). And for the Board Marketing and Underwriting Committee the Chairman is Brad Lawton (Star Cutter). All of these leaders are experienced manufacturing business men and women and veterans of the MTM Board. These leaders give MTM continuity during these challenging times.

By Donna Motley, Vice President of Claims

HOW TO FILE A CLAIM – Sounds simple, right? There is more involved than one might anticipate.

Claims can be filed with our department via facsimile, e-mail or MTMIC’s Portal. (No one uses U.S. mail anymore – if for no other reason, it takes too long!) Early reporting is best. The longer the delay between the date of injury and the date received in our office results in additional investigation of the circumstances surrounding the incident. Causal relationship has to be identified. When claims are reported within one or two days of occurrence, most, if not all, details are still fresh in everyone’s mind. Similar to the childhood game of “re-telling” a story, the more time that passes, the more likely the story (or in this case, facts) can change. Studies have been done where five people witness the same motor vehicle accident, and there are five different versions as to “how” the accident occurred. Wait an additional five days and details tend to blur, change or be forgotten.

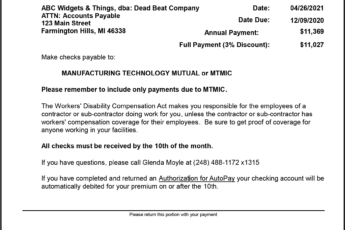

(more…)MTM prides itself on offering some of the best service in the insurance industry. That commitment to service includes working with our policyholders to fit their premium payments to their individual needs. Recently we did an analysis of the ways policyholders make their premium payments and were rather surprised at what we found.

The most used payment method was Pay in Full, where the policyholder pays the entire year’s estimated premium up front and gets a 3% discount. Even though only 97% of the year’s premium is paid up front, 100% of the estimated premium is credited when the final audit is processed. In 2020 over 1/3rd of our policyholders took advantage of Pay in Full with savings of almost $143,000.

(more…)