With the fiscal year closed, Chris Doebler our CFO has been working long hours to put the 2021 loss and financial reports for our independent actuarial team together. At the end of January, Chris and I meet with our lead actuary to review the 134-page report on the year’s loss results. Lots of detail reviewed with evaluations completed with multiple methodologies. Predicting the future value of 2021 claims that recently happened and how prior year claims are being presently handled today is as much an art as it is a science. On January 31, the actuarial team, Chris and I all agreed on the 2021 “loss numbers”. Now we quickly plug those into the financial statements for profit review.

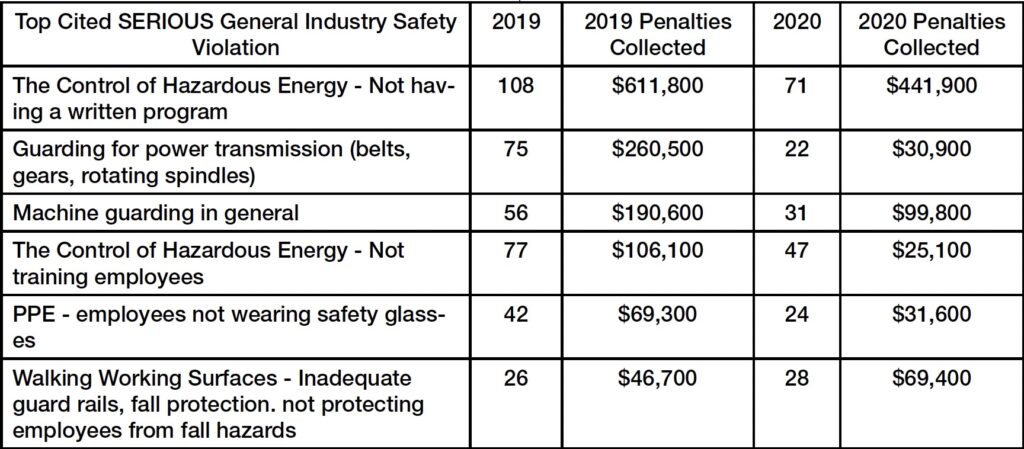

From an overall loss review, a few findings are apparent. The 2021 year was not a get back to “normal” year that we all had hoped for back in January 2021. The COVID disruptions were different than 2020, but still a significant factor in our business and personal lives. In aggerate our members activities grew for 2020, but not back to 2018 or 2019. Maybe this slower pace contributed to a reduction in frequency of severe losses. We had no fatalities in 2021 and fewer severe losses such as amputations. That is the good news. On the bad news side, we saw an increase in losses for new employees (90 days or less). Training was an issue in nearly all these cases. We understand the pressure to produce product and get the new employees in the production process. From our accident reviews, training and supervision of the new employees is a shop challenge. While it is most challenging to take the time to train in today’s world, I can report firsthand that a serious injury is the surest way to stop all shop production. It is important to the shop’s success that we send the employee home in the same condition as they arrived in the morning.

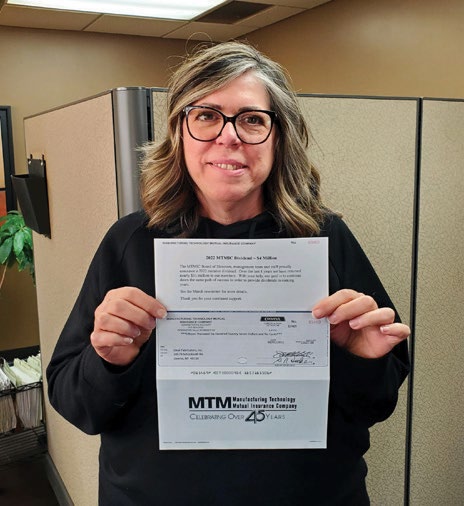

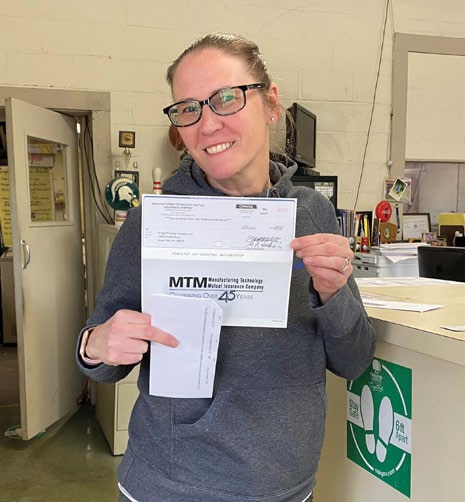

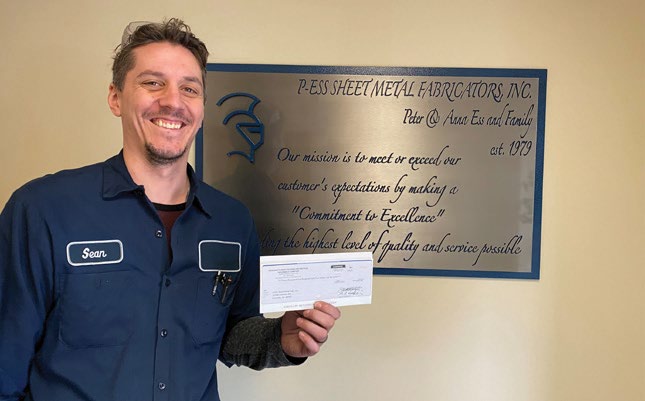

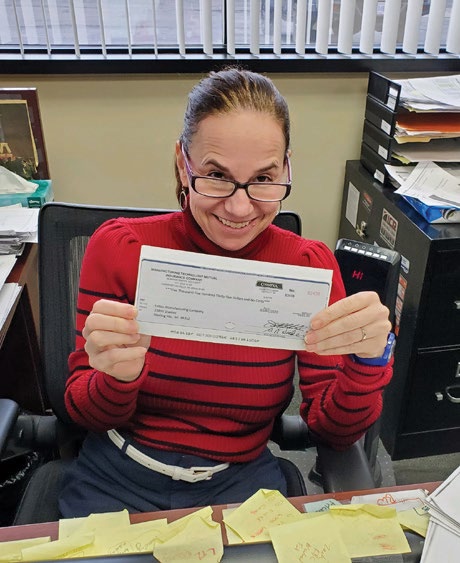

Our Loss Control staff is focusing on that issue for our members’ benefit. My task for the next couple weeks is to work the members’ dividend through the Board Marketing, Board Finance, and then full Board meetings. Our goal is to finalize MTM members’ declaration before February 17th and then manage the print and reporting process for deliveries to begin March 1st. In the meantime, you can help our next year’s dividend by paying special attention to your newest employees.

Be safe and see you soon. – John